Youre making wellsfargo and you may typing an online site one Wells Fargo does not manage. Wells Fargo has furnished so it connect for your benefit, however, doesn’t endorse in fact it is not guilty of the content, backlinks, privacy, or protection policy of web site.

A business credit software experience individuals strategies to test and you may ensure a good and you may comprehensive feedback. An individual application can be seen by the loan providers, underwriters, and you can experts – or it will experience a quick automated techniques, with regards to the proportions and kind out of credit questioned.

Throughout circumstances, it is vital to provide precise or more-to-time information regarding the applying. This will help to it proceed through the process as quickly as you’ll be able to.

Because you wait for an answer, you’re interested knowing what are you doing behind-the-scenes. Speaking of some of the amounts that application may go compliment of one which just listen to right back in the financial.

1. Very first confirmation

The first class to deal with the mortgage application commonly browse the things. This community will guarantee that the details about the application form try right and that the lending company provides all the vital information so you can decide. A number of the some thing they are going to make certain was:

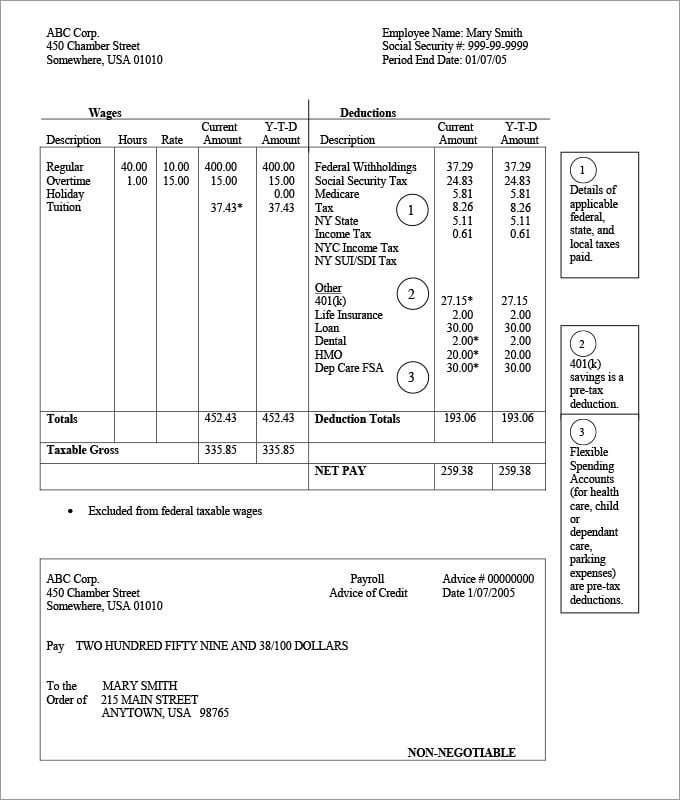

- Income and costs

- Time in organization and you may/or age providers (in the event the ordered mode a previous owner)

- Individual and you may providers credit reports

- Control info

Should your company have levels with the financial, that recommendations would be reviewed as well. For example, lenders may comment things like checking and savings membership, the fresh big date those people membership were open, together with twelve-day mediocre balances, as well as bank card membership stability and you can money.

dos. Scoring

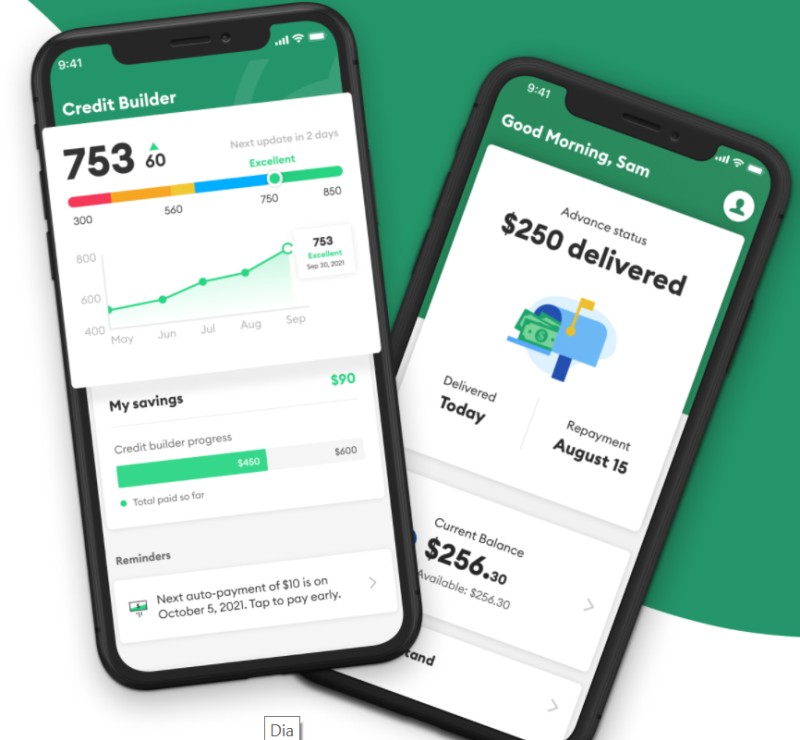

Shortly after all analysis regarding software is verified, the financial institution deliver the business a get to decide their creditworthiness. Certain products that come toward gamble are cashflow, expenses, financial obligation, age the business, and just what equity exists.

It’s important to recall the newest number will range from lender so you’re able to financial. Some lenders utilize the FICO Score model (for real house money, instance), although some utilize the FICO Vehicle Score (to possess car loans) and/or FICO Bankcard Rating (to have credit cards). They’ll plus see personal and business scores. And several loan providers can use rating models aside from FICO .

Of numerous loan providers will use globe-particular scoring, too, as the different varieties of companies have additional amounts of chance. Including, health care methods tend to have good steadier 12 months-round cashflow than just food provider and you will regular businesses. Which is partly because additional pushes instance weather, the latest benefit, and gives can cost you are apt to have more substantial affect the latest latter. But not, brand new pandemic enjoys impacted of a lot people in another way – as well as some health care means, and therefore watched falls in-patient visits – making sure that can get effect scores, as well. Discover more at the Skills Credit ratings and present Your credit score a Checkup (and an increase).

step three. Underwriting

Rating is more otherwise quicker automated – and can even lead to an automated recognition – however in some cases, the choice to approve that loan will get move on the underwriter. This is the underwriter’s work to take a far more outlined and you will nuanced look at the latest wide variety and also make the best choice whether or not the level of risk to your lender is acceptable. The latest underwriter can decide if or not the one thing appearing higher risk (such as for instance lifetime running a business) try counterbalance by the almost every other benefits (eg feel releasing past businesses otherwise market standards and you will/or individual consult).

Besides giving a credit card applicatoin or otherwise not, underwriters provides an alternative choice: recommending that quantity Riverside installment loan no credi checks no bank account of borrowing from the bank end up being modified. Maybe they will accept a lesser amount of or they might believe that the one thing such as the borrower’s money qualifies him otherwise the woman for a top borrowing limit.

4. Latest data verification

That is an extra, a lot more inside-depth view of all the provided investigation. So it round regarding review talks about one discrepancies regarding analysis such as:

- Company labels

- Private and organization tackles

- Personal Safeguards quantity

Whenever they discover people variances involving the application and specialized ideas, they must make certain the correct pointers, that may produce delays.

5. Finalizing and you may financial support

After things are acknowledged and confirmed, the fresh new candidate is notified of your own choice, the borrowed funds account are started, additionally the loans are produced offered to the business.

Be sure to certainly see the terms of the loan and you can perform a definite arrange for being on the right track with payments. The higher you could potentially show their creditworthiness, the easier it could be on the best way to getting approved to own borrowing afterwards.

Resources having Business

- Monitoring the credit rating statement and you will credit history

- Borrowing possibilities

Recommendations and you may feedback given is actually general in the wild and therefore are perhaps not courtroom, taxation, otherwise financial support suggestions. Wells Fargo renders zero guarantees concerning precision or completeness out of guidance, in addition to but not restricted to recommendations available with businesses; doesn’t endorse one low-Wells Fargo people, points, or functions described right here; and you may takes no responsibility for your use associated with information. Pointers and you will recommendations regarding company risk government and you may protection dont always represent Wells Fargo’s team practices or experience. Please get hold of your very own court, taxation, otherwise monetary advisers regarding your particular business need before you take people action depending this particular article.