Interest levels and you can loan restrictions towards USAA unsecured loans are topic adjust anytime and you will confidence the fresh new borrower’s borrowing records and you will finances. As a broad guide, below are a few facts during this writing:

- Lowest loan amount: $2,five-hundred

- Limitation loan amount: $one hundred,100000

- Interest rate assortment: six.49% so you’re able to %

- Fees title duration: several to 84 weeks

- 36 day restriction for finance less than $5,100

- forty-eight few days loan places Wallingford Center maximum to possess money below $10,100

- sixty few days limitation having loans below $fifteen,000

- 72 few days restriction to possess fund lower than $20,000

- Savings available for automated mortgage payment

USAA cash-away refinancing

USAA also provides dollars-away refinancing, but it may not make sense just in case you should use shorter loan wide variety. That is because new Va adds a great step three.6% money fee towards the refinance loan equilibrium, and therefore commission pertains to the complete amount borrowed, besides the money-away. It will be a good idea if you’d like a lot of money because the Va lets cash-out refinancing as much as a hundred% (even in the event lenders usually draw new range at ninety%).

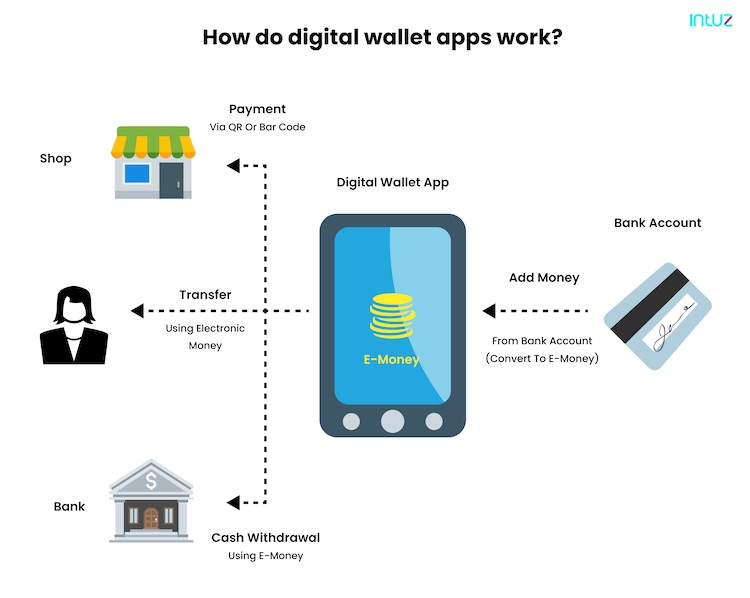

As the USAA will not provide HELOCs, its personal loans otherwise dollars-aside refinancing would be a great possibilities to help you starting a type of credit.

The main benefit of HELOCs is the independency that borrowers can be faucet the financing range and you may spend interest merely about what they normally use. But not, signature loans and money-away refinancing send swelling sums from the closure. Individuals instantaneously begin paying interest into whole financing harmony.

Cash-out refinancing get work with individuals which have seemingly brief mortgage balance who want serious cash. People should examine the cost of a money-away refinance with this away from a standard re-finance in conjunction with an excellent HELOC otherwise unsecured loan.

How to Submit an application for USAA House Guarantee Loans

Just like the noted a lot more than, because USAA will not give domestic guarantee funds, a personal bank loan otherwise bucks-aside re-finance would-be a practical substitute for specific consumers.

If your software program is recognized, USAA will teach the brand new debtor an interest rate render straight away. In the event your candidate chooses to proceed into the financing, money is generally available once a day after acceptance.

Generally, financing people should expect to provide their money and you may employment history. Might listing their obligations like lease, most other financing repayments, an such like. This will be to help the financial institution see whether people are able to afford to repay new mortgage.

Home owners submit an application for a money-out re-finance as they create with any financial tool and you will happen closing costs, assessment fees, and financial charges plus the Va funding payment.

USAA will remove a credit history before granting that loan. Before applying, consumers will be be sure statement on their own to find out if mistakes need are corrected or if they want to boost their credit score before you apply. A far greater credit history expands a keen applicant’s chances of recognition and you may may also garner a far greater rate of interest.

Remember that when a lender pulls a credit file, it can make an effective hard query. Too many difficult issues within this a short period can also be harm a great person’s credit rating. Thus, it makes sense to do some doing your research and you will restrict the brand new world of potential loan providers before you start in order to fill in programs.

USAA Professional and you will Consumer Critiques

The latest 2021 JD Stamina U.S. Consumer Lending Pleasure Data offered USAA a higher get for personal funds than just about any of your eight other companies ranked.

While doing so, Debts built-up investigation from 10 more specialist and individual information sites and you may averaged the reviews to possess USAA into the websites. Individual feedback having USAA was indeed only available into four of your ten internet sites. In which you are able to, studies out-of USAA’s signature loans were utilized; if men and women just weren’t offered, ratings to own USAA full were utilized.